property tax in nice france

Every region differs but as an example a big two bedroomedtwo bathroom home in Pas de Calais 12 th most expensive property region in France and acre of land is approximately 600 per. For properties less than 5 years old stamp duty is just 07 plus VAT at 20.

Get To Grips With French Property Taxes Everything Overseas

Here is how it is calculated.

. Discover Nice With These Unique Experiences. Any person living abroad and owner of real estate in France is subject to French property tax. Any owner of real estate in France on 1 st.

The tax rate varies between 050 and 150 of the declared value of the. The calculation of tax on 18650 using the rates and bands that apply for 2021 is. From 800000 to 1300000 05.

17 hours agoThe city is figuring out how to raise an additional 1 million per year in 2023 and 2024 to improve local streets and is considering raising taxes. For properties more than 5 years old stamp. From 0 to 800000 0.

There are various local and national taxes to take into consideration plus maintenance charges if you. Any owner of real estate in france on 1 st january of the taxation year must pay the property tax during the. Best Things To Do in Nice.

This amount is further increased by 6000 for each additional dependant in the household. Land tax taxe foncière and residence tax taxe dhabitation. IFI tax rates depending on the property value.

Property Tax In Nice France. The property tax is calculated annually by the tax authorities according to the cadastral rental value of the property and the rate determined by the local authorities. 0 to 10225 0 11 10226 to 26070 8424 at 11 926 This sum is then multiplied by 3.

The two main property taxes are. This will be followed by a 65 per cent reduction in 2019 and a 100 per cent. Individuals who are residents of another state are also liable to the IFI on.

Local Experiences Tours and Activities. In french its known as droit de mutation. The tax applies to all worldwide property regardless of its location on the territory of France or abroad.

Taxe dhabitation a local community tax paid by the owner or tenant. From 1300000 to 2570000 05. The owner of real estate in France pays two basic taxes.

Anyone who lives in France pays the tax dhabitation. Taxe foncière Land Tax Taxe dhabitation Housing or Residence Tax There are currently reforms underway to abolish the Taxe. These include a departmental tax usually 45 of the purchase price as well as a communal tax at.

For properties more than 5 years old stamp duty is 58 or 508 in some departments. That is to say that you declare everything you have received. Ad Find Top Attractions in Nice.

A homebuyer can expect to pay about 7 of the purchase price of an existing property in taxes and fees such as stamp duty notary fees and transfer taxes he said. There is no exemption. There are 2 types of property taxes in France the taxe dhabition and the taxe foncière.

There are also transfer taxes due when a home is purchased she said. The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property. No matter if you own or rent the place as a.

HAUTS DE FRANCE. You are liable for this tax if the net value of your property in France exceeds 1300000 euros. Property taxes and charges in France are notoriously complicated.

If your property income from furnished rentals is less than 70000 in revenue per year you may benefit from the micro regime.

France Crypto Is Now Moveable Property Tax Down From 45 To 19 Percent

French Property Tax Hikes Scheduled For 2022

French Taxes I Buy A Property In France What Taxes Should I Pay

Post Brexit 20 000 Tax Windfall If You Own A Second Home In France

French Property Income Tax Non Resident Tax Return Filing Pti

French Tax Collectors Use A I To Spot Thousands Of Undeclared Pools The New York Times

An International Comparison Of Real Estate Property Taxes Eye On Housing

Legal Advice Property Tax In France Aix En Provence Marseille Cm Tax

Tax Aspects Of Owing Property In France Or What Is A Real Value Of Your French Villa Glagoliza News

Second Home Or Main Address French Property Tax Rules Explained

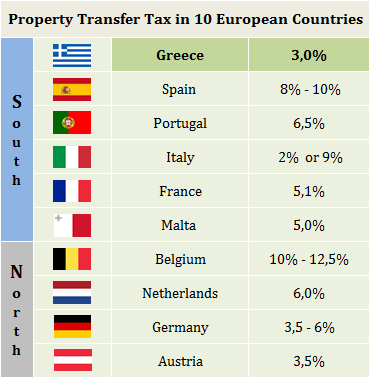

Property Transfer Tax In South And North Europe

The Tax Implications Of Owning A French Property Complete France

Taxe Fonciere In France French Property Tax Explained

Share Of Total Property Taxes And Immovable Property Taxes In The Eu Download Scientific Diagram

Property Tax Definition History Administration Rates Britannica

Taxes In France A Complete Guide For Expats Expatica

Taxes On The Purchase Of Real Estate In The French Riviera Site Name

French Taxes I Buy A Property In France What Taxes Should I Pay